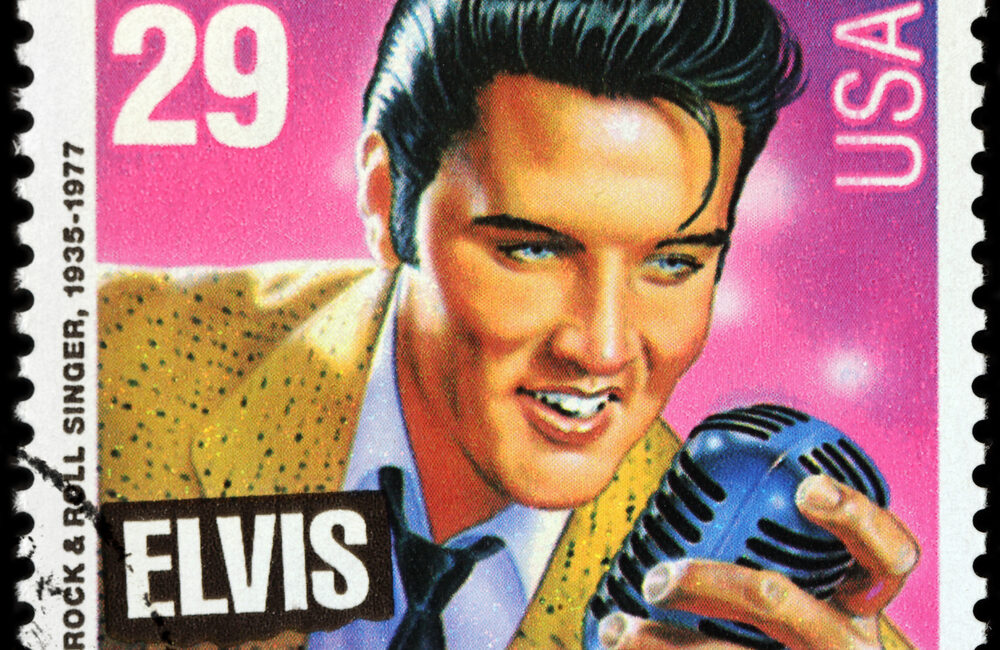

Elvis Presley, affectionately known as the “King of Rock n’ Roll”, is one of the most iconic figures in the music industry. He is still known today for his electrifying performances, extensive film career, and selling millions of records worldwide. His unexpected passing on August 16, 1977, at the age of 42, shocked the world and left people with many questions about his Last Will and Testament.

With Elvis’s notoriety and high-value estate, it is not surprising he would have a Last Will and Testament. However, despite having this document, the execution of its terms and distributions of assets had many complexities, giving the public valuable lessons they can apply to their own estate planning. At Fratello Law, we understand the details of Elvis Presley’s Last Will and Testament and important takeaways to help create an effective estate plan tailored to your needs. With our compassionate and family-oriented team by your side, you can rest assured you are in the right hands.

Who Was Named in Elvis Presley’s Last Will and Testament?

Elvis’s Last Will and Testament names three beneficiaries: his grandmother, Minnie Mae Presley; his father, Vernon Presley; and his daughter, Lisa Marie Presley. His grandmother and father passed away within a few years of Elvis’s death, so Lisa Marie was left as the only beneficiary. Elvis’s entire estate was placed in a trust for the maintenance, support, and education of his daughter and other relatives in the trust. Lisa Marie took complete control of her inheritance when she turned age 25.

Presley’s father, Vernon Presley, was named the executor of the Last Will and Testament, meaning he had the responsibility to administer the Last Will and Testament and ensure Elvis’s wishes for distributing his property were fulfilled. Elvis’s Last Will and Testament also stated that Vernon Presley could name a successor executor. If Vernon Presley could not have served as executor, the National Bank of Commerce of Memphis would have done so. Many challenges after Elvis’s death arose from a lack of planning and financial savvy on Vernon Presley’s part.

What Lessons Can We Learn From Elvis Presley’s Last Will and Testament?

As Vernon Presley, the executor of Elvis’s Last Will and Testament, was not the most financially knowledgeable, he often deferred to Elvis’s manager, “Colonel” Tom Parker, for advice. Subsequent to Elvis Presley’s death, the Presley Estate sued Colonel for fraud. The Colonel was found guilty of self-dealing and overreaching with respect to Elvis Presley’s earnings. Tom Parker was not a trustworthy and responsible individual. When Vernon Presley turned to Tom Parker for advice regarding the estate, he put the assets of the estate in jeopardy. Elvis Presley should have nominated a more qualified executor in his Last Will and Testament.

Consider Using a Trust

While Elvis’s Last Will and Testament failed to cover certain crucial aspects of estate planning, his Last Will and Testament did provide for certain types of testamentary trusts. For example, Lisa Marie Presley’s inheritance was monitored through a minor trust until she turned age 25.

Address Estate Tax

When creating your estate plan, it is important to consider ways to reduce the value of the taxable estate in order to increase the value of your loved one’s inheritance. Estate tax must be paid within nine months from the date of death. Elvis’s Last Will and Testament did not provide for estate tax planning.

Prepare Children for Their Inheritance

Lisa Marie Presley gained full control of her inheritance when she turned 25, per the terms of her Dad’s Last Will and Testament. She assumed a major responsibility and was faced with a great learning curve, as she had to learn the complexities of the business and how to manage the assets. Preparing children for their inheritance and putting the proper protections in place can help eliminate these issues.

Choose an Executor and Successor Executor With Care

Elvis appointed his father as the executor, but his father was also his business manager and elderly at the time, so he may not have been the best choice for this role. The potential conflict of interest also could have created issues during the estate planning process. Due to the complex nature of the estate, a more qualified executor may have done a more detailed and effective job. Therefore, it is critical to choose your executor and successor executor with great care.

Elvis Presley’s Last Will and Testament teaches us the importance of detailed planning and choosing the right executor. With the help of our experienced team at Fratello Law, you can start estate planning early to ensure nothing is overlooked and your loved ones’ futures are secure.

Our empathetic attorneys at Fratello Law work hard to build trust and create high-quality relationships with our clients. We are a small firm with a big heart, providing the support you need through every stage of life and the estate planning process. To schedule a no-cost consultation today, call us at (631) 406-5580 or fill out our contact form. We look forward to welcoming you to our client family.